crypto tax accountant ireland

We only list CPAs crypto accountants and attorneys. He is happy to help me from company initiation and after.

The Ultimate Guide To Ireland Cryptocurrency Taxes In 2022 Coinledger

Applied in an Irish context this would mean the same tax rate for individuals up to 55 and a higher tax rate for companies 25.

. 27 January 2020 Jamie McCormick As cryptocurrency becomes increasingly more mainstream even if it still remains a niche among Irish users the Chartered Accountants Ireland have posted an interesting update to their coursework for receiving their accreditation. In Ireland crypto investments are treated just like investments in stocks or shares. Note that not making any profits during a year does not relieve you of your filing obligations.

Crypto tax ireland Well help navigate you through the emerging world of cryptocurrency tax in Ireland. Crypto tax reports for accountants. Well ensure you tax returns are accurate and up to date as you maximise your cryptocurrency gains.

Leading crypto tax accounting services in Dublin Ireland. Crypto tax accountants in Ireland. However if your annual profits dont exceed 1270 youll be exempted from all taxes on your gains.

Crypto Tax Countries we Support We provide crypto tax reports for the United States of America United Kingdom South Africa Japan Australia Switzerland Spain Ireland France Norway and Germany. Other than that you can also offset your losses against your gains. 97 Malahide Road Clontarf Dublin 3 Ireland.

If you sellexchangegift crypto between 1st January to 30th November you need to pay the tax by 15th December of the same year. Dashiell Shapiro Wood LLP Matt Metras MDM FINANCIAL SERVICES Adam Gutierrez Lobo Accounting Jaya Dahal Focus Accounting CPA Firm Tom Koceja CPA Consensus Accounting and Tax PC. Easily generate crypto tax reports for your clients with Coinpandas software suite for CPAs and tax professionals.

Manage all clients from a single dashboard. 015677380 Client Reviews Moved to Liam Burns a year ago from a large contracting solutions provider as I felt their service is not personalised enough. With our clear transparent pricing structure you can find a solution that suits your needs with no hidden extra costs.

In summary Revenue have taken the stance that no unique tax rules are required for crypto assets - as such the taxation of income or gains arising from crypto assets is subject to Irelands existing tax principles on a case-by-case basis - namely Capital Gains Tax CGT IncomeCorporation Tax VAT PAYE and Stamp Duty. Whenever you sell spend or swap crypto in other words dispose of it youll pay a flat 33 tax rate on your capital gains. Yes Cryptocurrency is taxed in Ireland.

On this basis the euro value at the time of receipt of the crypto awarded would be the taxable amount but with a deduction allowed for any expenses of a non-capital nature incurred in earning that crypto. Tax reports compliant with the IRS ATO HMRC CRA and others. Laura Walter Crypto Tax Girl.

Generate Form 8949 and other country-specific. Crypto Accountants in Ireland Find a certified tax professional specializing in cryptocurrency taxes to help with your declarations. In other words if youre making profits or losses through the disposal of your cryptocurrency whether by selling gifting or exchanging you need to pay a 33 Capital Gains Tax CGT to Revenue.

Find A Crypto Tax Accountant Connect with a crypto tax expert All CPA Tax Attorney All accountants Nicole Green NNG TAX Group Inc. In Ireland cryptocurrency attracts both Capital Gains Tax and Income Tax according to the latest eBrief issued by Irelands Revenue in April of 2022. We understand Crypto and DeFi income sources.

For disposals between 1st to 31st December you will have to pay Capital Gains Tax by 31st January of the following year. In this complete tax guide you will learn everything you need to know about how crypto is taxed in Ireland how much tax you pay on your crypto gains how to calculate your crypto taxes how. Only the amount over and above 1270 is.

However the first 1270 of your cumulative annual gains from crypto after deducting expenses and losses from crypto investments are exempt from tax. Your search for a reliable crypto tax advice in Ireland ends here. CRYPTO TAX SOFTWARE FOR ACCOUNTANTS.

All companies listed here are well versed with cryptocurrency trading mining and other forms of. Ireland accounting firm with experience in crypto taxation. Capital Gain Taxes.

When Do You Need A Crypto Accountant Koinly

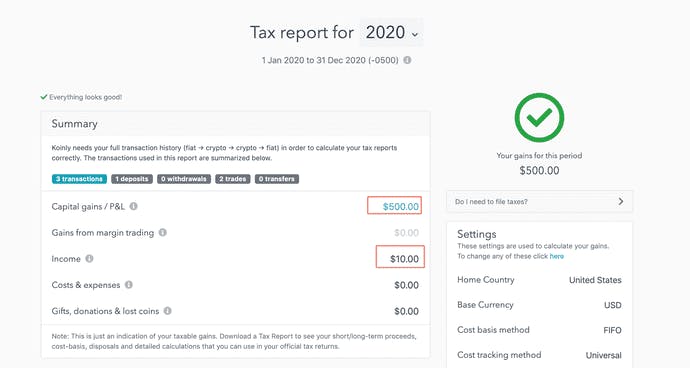

Cryptocurrency Tax Accountants Koinly

The Ultimate Guide To Ireland Cryptocurrency Taxes In 2022 Coinledger

The Ultimate Guide To Ireland Cryptocurrency Taxes In 2022 Coinledger

Ireland Cryptocurrency Tax Guide 2021 Koinly

Lalor Company Cryptocurrency Tax Services In Ireland Lalor And Company

Ireland Cryptocurrency Tax Guide 2021 Koinly

The Ultimate Guide To Ireland Cryptocurrency Taxes In 2022 Coinledger

The Ultimate Guide To Ireland Cryptocurrency Taxes In 2022 Coinledger

Best Free Crypto Tax Tool Crypto Com Tax Tutorial

Guide To Crypto Taxes In Ireland Coinpanda

Ireland Cryptocurrency Tax Guide 2021 Koinly

Crypto Tax Accountant Us Ca Uk Sa Solve Your Burden Today

I M A Crypto Tax Attorney Ama Today Jan 27 Starting At 10 Am Est R Cryptocurrency

Itas Accounting Cryptocurrency Accountant In Ireland Koinly

Guide To Crypto Taxes In Ireland Coinpanda

Bradley Tax Consulting Cryptocurrency Accountant In Ireland Koinly

The Ultimate Guide To Ireland Cryptocurrency Taxes In 2022 Coinledger

.jpg)

The Ultimate Guide To Ireland Cryptocurrency Taxes In 2022 Coinledger